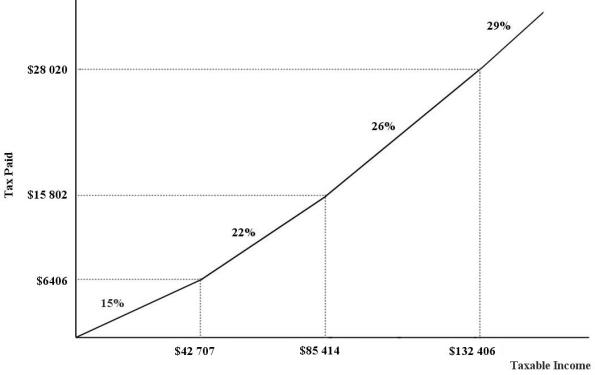

The figure below show a simplified version of the current (2015) Canadian federal income-tax system.The marginal income-tax rates for the four ranges of income are 15%,22%,26%,and 29%,respectively.  FIGURE 18-2

FIGURE 18-2

-Refer to Figure 18-2.An individual with a taxable income of $98 125 will pay $________ in income taxes.

Definitions:

Cognitive Impairments

Difficulties or limitations in mental functions such as thinking, memory, attention, and learning abilities.

Facial Deformities

Physical anomalies or irregularities present in the face, often present from birth or developed later, which can affect appearance and sometimes function.

National Exams

Standardized tests administered by a government or authoritative body that students must take at certain stages of their education, typically to measure aptitude or achievement.

Scholastic Aptitude Test

A standardized test commonly used for college admissions in the United States, assessing mathematical and verbal abilities.

Q5: The construction of the TransCanada highway is

Q22: Refer to Table 20-5.The real GDP in

Q25: An equivalent term for "real national income"

Q33: Canadian studies on the effects of minimum-wage

Q36: Refer to Figure 21-1.If disposable income is

Q69: What is the most fundamental purpose of

Q91: Refer to Table 20-5.The nominal Gross Domestic

Q100: When designing a policy to reduce polluting

Q104: In macroeconomics,what is the output gap?<br>A)the measure

Q119: Possible implications of corporate income taxes being