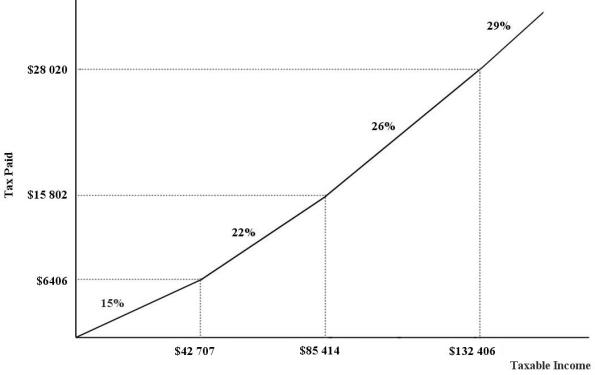

The figure below show a simplified version of the current (2015) Canadian federal income-tax system.The marginal income-tax rates for the four ranges of income are 15%,22%,26%,and 29%,respectively.  FIGURE 18-2

FIGURE 18-2

-Refer to Figure 18-2.This income-tax system can be characterized as

Definitions:

Font Size

The measure of how large or small the text appears in a document or webpage, often adjustable by the user.

Change Font

The process of altering the style, size, and appearance of textual characters in a document or application interface.

Alignment

The arrangement or positioning of text, objects, or data within a document, webpage, or application to ensure a cohesive and aesthetically pleasing layout.

Split

A function in computing that divides a window or screen into separate sections to view different parts of a document or dataset simultaneously.

Q3: Federal regulation aimed at reducing greenhouse-gas emissions

Q6: The marginal propensity to consume is defined

Q37: A nation's real national income in a

Q99: Refer to Table 21-5.The equilibrium level of

Q110: The aggregate expenditure (AE)function is an upward-sloping

Q112: The Canada (and Quebec)Pension Plans (CPP and

Q112: Which of the following statements regarding housing

Q118: If all university students had to pay

Q118: Refer to Figure 14-2.If the labour market

Q123: The Smith family's disposable income rose from