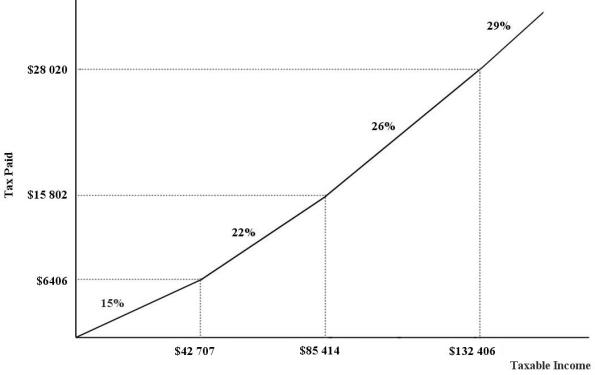

The figure below show a simplified version of the current (2015) Canadian federal income-tax system.The marginal income-tax rates for the four ranges of income are 15%,22%,26%,and 29%,respectively.  FIGURE 18-2

FIGURE 18-2

-Refer to Figure 18-2.What needs to be true about the four marginal income-tax rates in order for this tax system to be considered regressive?

Definitions:

Arraignment

A court hearing where a criminal defendant is formally charged and asked to enter a plea of guilty, not guilty, or no contest.

Indictment

A formal charge or accusation of a serious crime issued by a grand jury.

Commercial Speech

Refers to speech or messages that primarily involve the commercial interests of the speaker and the audience, often related to advertising or marketing.

First Amendment

A modification to the U.S. Constitution ensuring rights related to religious practices, speech, gathering, and the ability to formally request changes.

Q2: The social marginal cost of the production

Q9: Refer to Table 21-7.The simple multiplier in

Q15: Changes in productivity can be analyzed by

Q44: Suppose that a regional health authority is

Q45: What is meant by the term "market

Q81: Consider the government's budget balance.Suppose G =

Q84: Since corporate income taxes are levied on

Q91: Consider a firm making a decision to

Q106: A firm can finance its purchase of

Q123: The use of emissions taxes as a