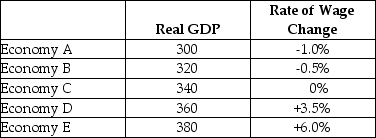

The table below shows data for five economies of similar size.Real GDP is measured in billions of dollars.Assume that potential output for each economy is $340 billion.

TABLE 24-1

TABLE 24-1

-Refer to Table 24-1.Which of the following statements best describes the situation facing Economy B?

Definitions:

Operating Leverage

A financial measure of a firm's fixed versus variable costs, which assesses how revenue growth translates into growth in operating income.

Financial Leverage

The use of borrowed funds to increase the potential return on investment.

MM Model

The MM Model, or Modigliani-Miller Theorem, is a finance theory that suggests market value of a company is determined by its earning power and risk of underlying assets, independent of its capital structure.

Cost Of Equity

The return a company requires to decide if an investment meets capital return requirements, often used in capital budgeting to evaluate projects.

Q5: Consider an AD/AS model in long-run equilibrium.An

Q10: If the annual market interest rate is

Q26: Commercial banks hold a fraction of their

Q35: In the long run,aggregate demand is _

Q65: The expansion of deposits resulting from an

Q92: Suppose the economy is in macroeconomic equilibrium

Q105: Consider a new deposit of $10 000

Q113: An increase in foreign income,other things being

Q121: On a graph that shows the derivation

Q136: Refer to Figure 23-1.Assume the economy is