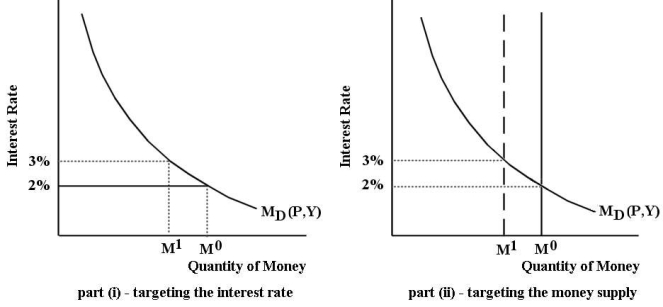

The diagrams below illustrate two alternative approaches to implementing monetary policy.The economy begins in monetary equilibrium with the interest rate equal to 2% and the money supply equal to  .

.  FIGURE 28-1

FIGURE 28-1

-Refer to Figure 28-1.The Bank of Canada must be able to easily communicate its monetary policy actions to the public.Which approach is more amenable to this requirement,and why?

Definitions:

Current Liabilities

Liabilities due within a short period, typically less than a year, that are supposed to be paid out of current assets.

Debt to Equity Ratio

A financial ratio indicating the relative proportion of shareholders' equity and debt used to finance a company’s assets.

Total Liabilities

This term represents the aggregate of all debts and financial obligations owed by an entity to outside parties at any given point in time.

Stockholders' Equity

The residual interest in the assets of a corporation after deducting liabilities, representing the ownership interest of shareholders.

Q19: The Canadian tax and transfer system acts

Q29: Over the long term,by far the most

Q30: According to the "liquidity preference" theory of

Q42: A rightward shift in the AD curve

Q52: Which statement by an employer is consistent

Q53: The Neoclassical theory of economic growth led

Q57: Refer to Table 26-2.Assume that Bank North

Q83: If the Bank of Canada validates a

Q108: Consider the market for financial capital in

Q111: Consider a closed economy with real GDP