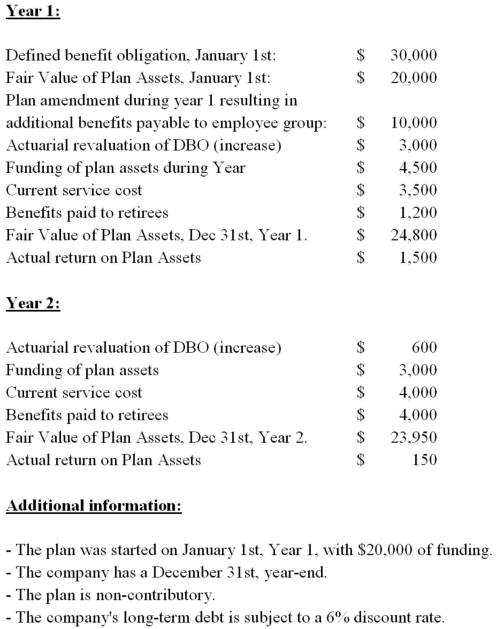

Jamieson Corp.sponsors a defined benefit plan for its employee group. The following data pertains to the plan's first 2 years in existence:  Jamieson's pension expense as per ASPE for Year 1 would be:

Jamieson's pension expense as per ASPE for Year 1 would be:

Definitions:

FIFO Method

First-In, First-Out method is an inventory valuation approach where goods purchased or produced first are sold or used first.

LIFO Cost

LIFO (Last In, First Out) Cost refers to an inventory valuation method where the most recently acquired items are the first to be sold or used, affecting the cost of goods sold and inventory valuation.

Net Income

The amount of money left over after all operating expenses, taxes, and interest are subtracted from total revenue.

Physical Flow

The movement of physical goods through a production process or supply chain.

Q11: The taxes payable method results in better

Q34: The records for OTC Inc.showed the following

Q45: In a non-contributory,defined benefit pension plan,the plan

Q52: All of the following are evidence to

Q53: Disclosure related to tax loss carry forwards

Q75: In the long run,the projected unit credit,accumulated

Q90: If a company converted a short-term note

Q93: All temporary differences originate,then reverse,and eventually end

Q116: Induced conversions of convertible debt arise when

Q224: Sales-type leases are essentially a selling tool