Johnson Corp.sponsors a defined benefit plan for its employee group.

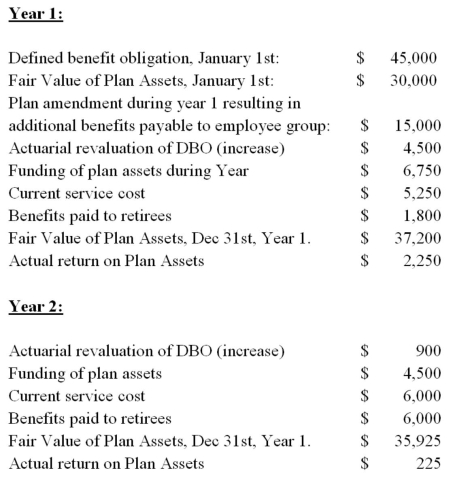

The following data pertains to the plan's first 2 years in existence:  Additional information:

Additional information:

- The plan was started on January 1st,Year 1,with $30,000 of funding.

- The company has a December 31st,year-end.

- The plan is non-contributory.

- The company's long-term debt is subject to a 6% discount rate.

Prepare a pension worksheet showing all relevant amounts for Years 1 and 2 with respect to Johnson's defined benefit pension plan.

Definitions:

Job Performance

The evaluation of how effectively an individual carries out their duties and responsibilities associated with their job role.

Webcam

A digital camera designed to capture images and videos for streaming over the internet in real time.

Skype

A telecommunications application software that provides video chat and voice call services over the internet.

Personal Brand

Your distinctive set of strengths, including skills and values.

Q12: A firm that earned $20,000 (after tax)had

Q15: An asset that cost $66,000 was being

Q23: Non-refundable payments made in advance on operating

Q28: Changing from an insupportable (bad faith)estimate to

Q78: For purposes of computing the weighted average

Q82: Ryan Corp.enters into and sale and leaseback

Q92: The accounts receivable turnover ratio is a

Q101: All individual temporary differences are expected to

Q105: All of the following are methods of

Q120: Diluted EPS indicate long-run impact that the