LAC has negotiated a lease agreement with LEC effective January 1,2014.LAC will provide LEC with a special-purpose building for ten (10)years.The lease is non-cancellable; requires LEC to provide maintenance,insurance,taxes,etc.; and stipulates that the building reverts back to LAC's control at the end of the lease.The building cost LAC $200,000 and is expected to have no residual value at the end of the lease.LAC expects a 15% return on investments and the lease qualifies as a direct financing lease.Rents are paid each December 31 starting in 2014.

(a)How much annual rent will the lessee pay (rounded to the nearest dollar)? $______________________________.

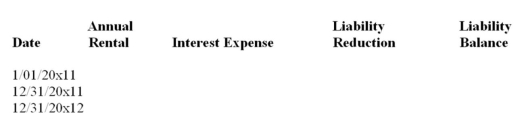

(b)Complete the following schedule of lease amortization for the lessee for the first two years:

(c)Complete the following entries for the lessee: January 1,2014,inception of lease.

December 31,2014,first rental payment and lessee's year-end entries (end of the accounting period).

December 31,2014,accrual by lessee of $4,000 taxes on the building and payment of $800 for repairs on the building.

Definitions:

Diversification

An investment strategy to reduce risk by allocating investments amongst various financial instruments, industries, or other categories.

Perspective of Stockholders

The viewpoint or interests of shareholders in a corporation, often focused on return on investment, governance, and financial health.

Offsetting Profits

Earnings that counterbalance or mitigate losses from another aspect of a company’s operations or investments.

Successful Mergers

The combining of two or more companies in a way that results in increased value generation, efficiency gains, and enhanced competitiveness in the market.

Q14: The following information pertains to ABC Inc.:

Q18: KAR's taxable income for the first five

Q22: JUNK BONDS Inc.began operations Jan.1,2014.The following events

Q28: EGR Corporation has one asset worth $450,000.Accumulated

Q35: XYZ reported the following equity accounts on

Q53: If a corporation only has one class

Q55: An escalation clause will normally cause preferred

Q68: An anti-dilutive effect means that EPS is

Q73: At December 31,2013,GHI had 400 common shares

Q87: Jamieson Corp.sponsors a defined benefit plan for