Lessor Company leases small computers on three-year leases at the end of which the residual value is not material in amount.Rents are collected at year-end.On January 1,2014,Lessor signed a 3-year lease with Lessee Company that called for annual rents of $12,063,which was a return to Lessor of 10% on the $30,000 cost (market value at date of lease).Assume the lease qualifies as a direct financing lease to the lessor and a finance lease to the lessee.There was no bargain purchase option or residual value.The lessee's incremental borrowing rate is 12%.

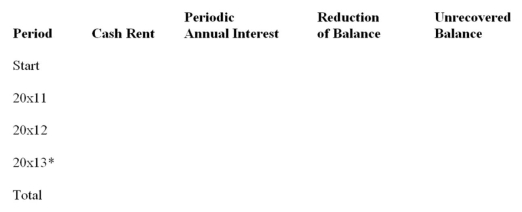

(a)Complete the following amortization schedule for the lease.

Round to the nearest dollar.  * May have slight rounding error.

* May have slight rounding error.

(b)Can both the lessor and lessee use the amortization schedule values in this instance?

Yes __________________ No ___________________

Explain why _________________________________________________.

(c)Give the entries for the lessor and lessee on the following dates (assume the accounting period ends December 31).Use the abbreviated account titles.

Definitions:

X-men Comic

A popular series of American comic books published by Marvel Comics, featuring a team of superheroes known as the X-Men who are born with superhuman abilities.

Lemonade Stand

A small, temporary drink stand often run by children, selling lemonade or similar refreshments, typically to learn about business and entrepreneurship.

Production Increase

A rise in the amount of goods and services produced by a company or economy.

Marginal Cost

The cost incurred by producing one additional unit of a product, reflecting how costs change with production volume adjustments.

Q18: S Corporation created a stock option plan

Q25: JMR Ltd.issued $300,000 of 7%,8 year,non-convertible bond

Q31: KER commenced operations in 2013.The company had

Q60: An asset cost $190,000; it is being

Q60: At December 31,2013,BCD had 700 common shares

Q79: Under IFRS,companies are required to disclose the

Q81: Contingent rent is a bargaining tool used

Q155: At the inception of a finance lease

Q167: Businesses engage in many transactions that are

Q210: Company A enters into a lease agreement