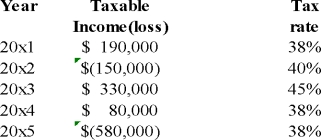

VB Ltd.provided you with the following information:  There are no temporary differences.The deferred income tax benefit of the loss carry forward was set up in 2015 as the probability of realization was greater than 50%.In 2016 a further loss of $140,000 was incurred.Management determined that they were still more likely than not to realize the loss.The tax rate for 2016 was 45%.What would be the carrying amount of the deferred income tax benefit/loss carry forward on the balance sheet at the end of 2016?

There are no temporary differences.The deferred income tax benefit of the loss carry forward was set up in 2015 as the probability of realization was greater than 50%.In 2016 a further loss of $140,000 was incurred.Management determined that they were still more likely than not to realize the loss.The tax rate for 2016 was 45%.What would be the carrying amount of the deferred income tax benefit/loss carry forward on the balance sheet at the end of 2016?

Definitions:

Slumming

The practice of visiting poorer urban areas for the purpose of entertainment or voyeurism by those from higher socioeconomic classes.

Jazz Clubs

Venues dedicated to the performance and enjoyment of jazz music, often featuring live bands and a vibrant atmosphere.

Ku Klux Klan

A white supremacist group originating in the southern United States post-Civil War, known for promoting racism, anti-Semitism, and violence against minority groups.

Respected Positions

Roles or titles within a society or organization that are held in high esteem due to the authority, responsibility, or expertise associated with them.

Q3: A trustee is independent and receives the

Q19: Bonds and preferred share adjustments are based

Q20: Under IFRS,net interest (finance)revenue or expense on

Q21: Bonds payable (due 5 years from the

Q77: Authorized share capital refers to the total

Q77: A temporary difference that is deductible in

Q92: Explain why a company would want to

Q98: What amount of sales is recognized by

Q113: If it is the company's option to

Q116: FED had 100 common shares issued and