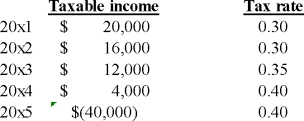

The following data represents the complete taxable income history for a firm:  What is the amount of the Deferred Tax Asset - carry forward to be recognized on the 2015 statement of financial position at the end of 2015,assuming that the more likely than not criteria has been met,and that the tax rate is expected to remain at 40% for the foreseeable future?

What is the amount of the Deferred Tax Asset - carry forward to be recognized on the 2015 statement of financial position at the end of 2015,assuming that the more likely than not criteria has been met,and that the tax rate is expected to remain at 40% for the foreseeable future?

Definitions:

Underlying Inflammatory

Refers to the foundation or basic cause of an inflammatory response within the body, which might be hidden or not immediately apparent.

Third-degree Burn

A severe burn characterized by destruction of the skin through the depth of the dermis and possibly into underlying tissues, often leading to significant scarring and requiring medical intervention.

Eschar

A dry, dark scab or falling away of dead skin, typically resulting from a burn or by the action of certain skin diseases.

Partial-thickness Burn

A type of burn that affects the first and second layers of skin, causing pain, swelling, and blistering, but not as severe as a full-thickness burn.

Q3: The lessee measures the cost of a

Q5: If the enacted tax rate is changed

Q20: Dilutive convertible securities must be used in

Q22: Temporary differences occur only because accounting standards

Q37: Dividends in arrears on cumulative preferred shares

Q47: Assume that a company issues bonds at

Q48: The reported diluted earnings per share figure

Q67: Borrowing costs can only be capitalized on

Q110: Basic EPS is an historical amount.

Q219: In an operating lease,if a non-refundable down