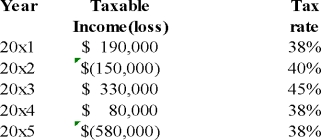

VB Ltd.provided you with the following information:  There are no temporary differences.The deferred income tax benefit of the loss carry forward was set up in 2015 as the probability of realization was greater than 50%.In 2016 it was determined that the probability of realization was less than 50%.What would be the carrying amount of the deferred income tax benefit-loss carry forward on the balance sheet at the end of 2016?

There are no temporary differences.The deferred income tax benefit of the loss carry forward was set up in 2015 as the probability of realization was greater than 50%.In 2016 it was determined that the probability of realization was less than 50%.What would be the carrying amount of the deferred income tax benefit-loss carry forward on the balance sheet at the end of 2016?

Definitions:

Cost of Capital

Refers to the opportunity cost of making a specific investment, representing the rate of return that could have been earned by putting the same money into a different investment with equal risk.

Short-Term Debt

Obligations or loans that are due to be paid back within a short period, typically one year or less.

Long-Term Debt

Borrowings and financial obligations lasting over one year, used to finance operations or acquisitions.

Capital Budgeting

The method by which a business analyzes prospective large-scale projects or investments.

Q2: At December 31,2013,BCD had 700 common shares

Q6: What is convertible debt? Why would a

Q36: What options are open to a company

Q47: Assume that a company issues bonds at

Q65: If cash payments to investors are dependent

Q88: Dividends in arrears on cumulative preferred shares

Q92: What interest rate does a lessee use

Q97: DCE had 900 common shares outstanding on

Q115: A firm reported the following in its

Q141: Lessor Company rented a machine to Lessee