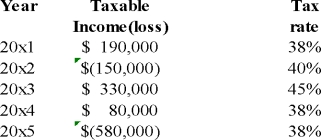

VB Ltd.provided you with the following information:  There are no temporary differences.The deferred income tax benefit of the loss carry forward was set up in 2015 as the probability of realization was greater than 50%.In 2016 a further loss of $140,000 was incurred.Management determined that they were still more likely than not to realize the loss.The tax rate for 2016 was 45%.What would be the carrying amount of the deferred income tax benefit/loss carry forward on the balance sheet at the end of 2016?

There are no temporary differences.The deferred income tax benefit of the loss carry forward was set up in 2015 as the probability of realization was greater than 50%.In 2016 a further loss of $140,000 was incurred.Management determined that they were still more likely than not to realize the loss.The tax rate for 2016 was 45%.What would be the carrying amount of the deferred income tax benefit/loss carry forward on the balance sheet at the end of 2016?

Definitions:

Responsible

Having an obligation to do something, or having control over or care for someone, as part of one's job or role.

Externship

A temporary training program in a workplace, especially one offered to students as part of a course of study.

Practicum

A period of practical experience and training for a student in a specialized field.

Educational Curriculum

A structured set of educational experiences, courses, or programs designed to achieve specific learning outcomes or objectives.

Q5: A stock option plan is a compensatory

Q11: When the market rate exceeds the stated

Q11: The following data represents the complete taxable

Q29: WEIGHTY Inc.started the current year with 2,000

Q76: The conversion option attached to convertible bonds,which

Q88: On January1st,2014,ABC Inc.(the lessor)agrees to lease a

Q92: MNO's taxable income was $900 during 2013.MNO

Q102: Golf dues paid for by a company

Q139: Under ASPE,a lessor may classify a lease

Q167: Ryan Corp.is a manufacturer of high tech