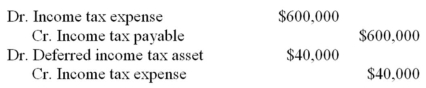

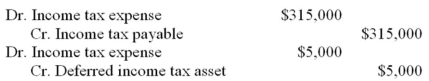

EGR Company provided you with the following information:

2013 Net Income: $1,500,000

2014 Net Income: $900,000

2013 Tax rate: 40%

2014 Tax rate: 35%

In addition,the only difference between accounting and tax are warranty costs accrued of $100,000 in 2013.No actual warranty expenses were incurred in 2013 or 2014.Prepare journal entries for 2013 and 2014 to record income tax expense.

Definitions:

Salvage Value

The forecasted resale price of an asset at the end of its service life.

Depreciation Expense

An accounting method used to allocate the cost of a tangible or physical asset over its useful life, reflecting wear and tear, deterioration, or obsolescence of the asset.

Straight-line Method

A method of calculating depreciation for an asset, spreading the cost evenly over its useful life.

Salvage Value

The calculated remaining value of an asset at the close of its productive life.

Q60: When treasury stock accounted for by the

Q60: Jamieson Corp.sponsors a defined benefit plan for

Q63: Under ASPE,disclosure in the footnotes to the

Q79: Explain what is meant by off-balance sheet

Q81: CCA is an optional deduction and may

Q84: Provide some arguments for and against the

Q89: A financial asset has any of the

Q97: The following information for LAS Corporation is

Q125: XYZ Rental leased a special crane to

Q211: If the title to a leased asset