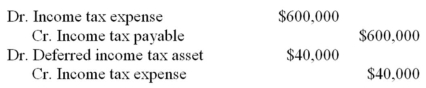

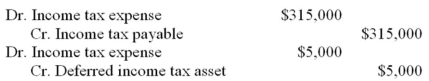

EGR Company provided you with the following information:

2013 Net Income: $1,500,000

2014 Net Income: $900,000

2013 Tax rate: 40%

2014 Tax rate: 35%

In addition,the only difference between accounting and tax are warranty costs accrued of $100,000 in 2013.No actual warranty expenses were incurred in 2013 or 2014.Prepare journal entries for 2013 and 2014 to record income tax expense.

Definitions:

Unbiased

Showing no prejudice or favoritism, maintaining impartiality.

Recorded Interview

An interview whose contents have been documented through audio or video recording.

Objective

An unbiased and impartial stance or goal that is not influenced by personal feelings or opinions.

Personal Biases

Individual preconceptions or prejudices toward specific groups, topics, or ideas that can affect judgment and decision-making.

Q15: Contingent gains may be accrued if they

Q51: How should a deferred income tax benefit

Q61: On 2 January 20X4,GHI Corporation was incorporated

Q85: Temporary differences very seldom reverse (i.e.,turnaround)in one

Q99: Ryan Corp.enters into and sale and leaseback

Q104: The conversion of preferred shares into common

Q109: VB Ltd.raises $150,000 by issuing a financial

Q145: ABC Inc.leased a computer to the Lennox

Q156: When stock rights are issued to current

Q191: The following information relates to a lease