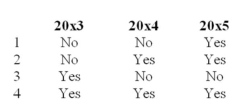

Compensatory stock options were granted to executives on January 1,20x3,with a measurement date of June 30,20x4,for services to be rendered during 20x3,20x4,and 20x5.The excess of the market value of the shares over the option price at the measurement date was reasonably estimable at the date of grant.The stock option was exercised on October 31,20x5.Compensation expense should be recognized in the income statement in which of the following years?

Definitions:

Q2: The crucial aspect of debt is that

Q9: When a part of the body is

Q38: JMR Corp.sustained taxable income in 2011 of

Q52: A company issues a financial instrument for

Q54: KG Company had capital assets with a

Q58: Under the effective interest method,interest expense is

Q103: A lease agreement includes the following provisions:

Q130: A lessee rented a machine that had

Q139: The December 31,2016,the balance sheet of TXY

Q226: On December 31,2015,JKL leased a new machine