On January 1st,20x9,GHI Inc.granted options to its twenty employees allowing for the purchase of 12,000 shares at $5 per share.The options vest evenly over the 3 years following the date of issue.The options are only exercisable as of December 31st,20x11.The fair value of these options (using an Option Pricing model)is $30,000.

Part A: Assume that all options have vested but that none were exercised on December 31st,20x11.Provide the required journal entry.

Part B: Assume that all options have vested and all were exercised on December 31st,20x11.Provide the required journal entry.

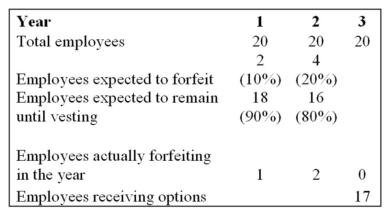

Part C: Suppose that some of the options were forfeited by the employees.Actual and estimated forfeiture data are provided in the table below:  Provide the required journal entries to record the accrual of compensation expense and the exercise of the options as per IFRS.

Provide the required journal entries to record the accrual of compensation expense and the exercise of the options as per IFRS.

Part D: Suppose that some of the options were forfeited by the employees.Actual and estimated forfeiture data are provided in the table below:

Definitions:

Fixed-ratio Schedule

A schedule of reinforcement where a response is reinforced only after a specified number of responses have been made.

Reinforcement

In behavioral psychology, a process in which a behavior is strengthened or made more likely to occur again by rewarding it or providing a positive stimulus.

Fixed Number

A quantity that remains constant and does not change or vary in a given context.

Varying Amounts

Different quantities or measures of something without a fixed or exact number.

Q1: If a company issues debt that is

Q62: There are 1000 μg in a mg.

Q64: On January 1,2014,BE Company collected a $15,000

Q66: What is the interest rate used for

Q82: Perpetual Debt is accounted for as equity.

Q85: KER Corp.issued 150,000 rights allowing the holder

Q89: A 5-year lease contract is signed on

Q115: Elizabeth Corp.owned a major business building in

Q145: Total equities of a corporation usually include:<br>A)

Q198: On January 1,2014,LOR leased a machine (original