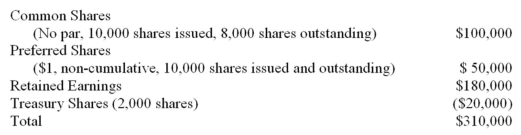

On December 31st,2011,JKL Inc.had the following account balances:

HYPERLINK "" Error! Hyperlink reference not valid.

JKL Inc.was incorporated in province allowing the existence of Treasury shares.

The company had no Accumulated Other Comprehensive Income (AOCI)balances on that date.

During 2012,the following took place:

JKL Inc.had a total Comprehensive Income of $150,000.

During 2012,JKL Inc.bought 2,000 shares of MNO Inc.for $45 per share.On December 31st,2012,these shares were trading at $60 per share.These shares,which were all on hand at the end of 2012,were designated by management as FVTOCI.These shares were the only items affecting Accumulated Other Comprehensive Income (AOCI).

Half of the treasury shares held by management at the start of 2012 were sold during the year for $15,000.

JKL declared at total of $30,000 in dividends,which included a common stock dividend valued at $10,000.

Required:

A)Prepare a Statement of Changes in Equity for JKL Inc.as per IFRS as at December 31st,2012.

B)Briefly explain how JKL Inc's reporting requirements would differ if it complied with ASPE instead of IFRS.

Definitions:

Lymphocyte Levels

The concentration or amount of lymphocytes, which are a type of white blood cell, present in the blood, an important indicator of immune system health.

Type A Personality

A personality type characterized by high levels of competitiveness, self-motivation, aggressiveness, and a sense of urgency, potentially leading to stress-related health issues.

Electric Shocks

A sudden discharge of electricity through a part of the body, which can be painful or harmful, used in various experimental and medical treatments.

Ulcers

Open sores that develop on the lining of the stomach, small intestine, or esophagus, often causing pain and discomfort.

Q19: An abrasive used in toothpaste is _.

Q24: Iodine is a metal.

Q24: A compound only contains one type of

Q25: The number 650 000 has two significant

Q42: In-substance defeasance means that a debtor irrevocably

Q45: Accounts payable should include only obligations directly

Q48: Which of the following is a characteristic

Q48: Which one of the following items is

Q86: GFH had pre-tax accounting income of $1,400

Q93: The atomic mass of an element is