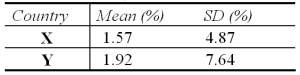

The mean and standard deviation (SD) of monthly returns,over a given period of time,for the stock markets of two countries,X and Y are  Assuming that the monthly risk-free interest rate is 0.25%,the Sharpe performance measures,SHP(X) and SHP(Y) ,and the performance ranks,respectively,for X and Y are:

Assuming that the monthly risk-free interest rate is 0.25%,the Sharpe performance measures,SHP(X) and SHP(Y) ,and the performance ranks,respectively,for X and Y are:

Definitions:

King George Iii

The King of Great Britain and King of Ireland from 1760 to 1820, whose reign included the American Revolutionary War and the loss of the American colonies.

American Loyalty

The sense of allegiance or fidelity to the United States, its principles, and its values.

Idea Of Independence

The concept that a nation, territory, or people should govern itself, free from external control or influence.

Class Conflict

The tension or antagonism which exists in society due to competing socioeconomic interests and desires between people of different classes.

Q18: ABC International has borrowed $4,000,000 at LIBOR

Q24: The authoritative body in the United States

Q28: Calculate the euro-based return an Italian investor

Q30: Find the Global Minimum Variance Portfolio.<br>With a

Q32: Find the net cash flow for the

Q40: What would be the interest rate?

Q50: Calculate the euro-based return an Italian investor

Q51: More than fifty percent of FDI in

Q67: A recent study of MNCs suggests that

Q83: Find the net cash flow in (out