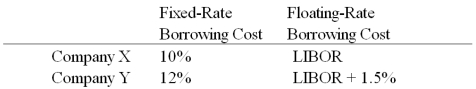

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years.Their external borrowing opportunities are shown below:  A swap bank proposes the following interest only swap: Y will pay the swap bank annual payments on $10,000,000 with a fixed rate of 9.90%.In exchange the swap bank will pay to company Y interest payments on $10,000,000 at LIBOR - 0.15%; What is the value of this swap to company Y?

A swap bank proposes the following interest only swap: Y will pay the swap bank annual payments on $10,000,000 with a fixed rate of 9.90%.In exchange the swap bank will pay to company Y interest payments on $10,000,000 at LIBOR - 0.15%; What is the value of this swap to company Y?

Definitions:

T-statistic

The T-statistic is a ratio used in hypothesis testing that compares the difference between an observed sample mean and a known value, to the standard error of the mean.

Null Hypothesis

A default hypothesis that there is no significant difference or effect, typically set against the alternative hypothesis in statistical testing.

Alpha

A coefficient used in statistics that represents the level of significance, often denoted as the probability of rejecting a true null hypothesis.

T-statistic

A type of statistic used in hypothesis testing, calculated to compare the mean of a sample to the known mean of the population.

Q5: Using your results to the last question,use

Q12: Regarding the mechanics of international portfolio diversification,which

Q42: Bilateral netting can reduce the number of

Q45: A bank may establish a multinational operation

Q52: Nominal differences in currency swaps<br>A)can be explained

Q53: The underlying principle of the current/noncurrent method

Q60: The floor value of a convertible bond<br>A)is

Q71: On the basis of regression Equation <img

Q77: Benefits of a multilateral netting system include:<br>A)The

Q99: Find the debt-to-equity ratio for a firm