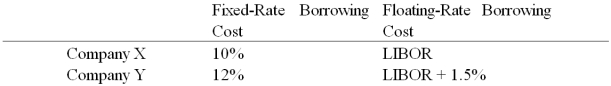

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years.Their external borrowing opportunities are shown below:  A swap bank is involved and quotes the following rates five-year dollar interest rate swaps at 10.05%-10.45% against LIBOR flat. Assume both X and Y agree to the swap bank's terms.

A swap bank is involved and quotes the following rates five-year dollar interest rate swaps at 10.05%-10.45% against LIBOR flat. Assume both X and Y agree to the swap bank's terms.

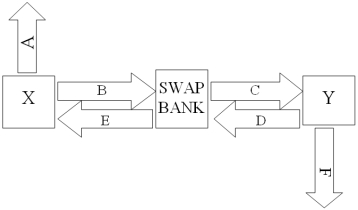

Fill in the values for A,B,C,D,E,& F on the diagram.

Definitions:

Genetic Variability

The diversity within and among populations in terms of genetics, which contributes to species' adaptability and evolution.

Captive Breeding

The process of breeding animals in controlled environments within human care, often used for conservation and research purposes.

Critical Habitats

Areas identified as essential for the conservation of endangered or threatened species, requiring special management and protection.

COSEWIC

The Committee on the Status of Endangered Wildlife in Canada, a group that assesses and classifies the conservation status of wildlife species at risk of extinction.

Q3: Find the ex post IRR in euro

Q5: Solve for the weighted average cost of

Q7: A measure of "liquidity" for a stock

Q11: In an agency market,the broker takes the

Q22: LIBOR<br>A)is the London Interbank Offered Rate.<br>B)is the

Q58: In what year were U.S.MNCs mandated to

Q63: Find the euro-zone cost of capital to

Q70: The simplest of all translation methods to

Q87: A swap bank makes the following quotes

Q93: Proportionately more domestic bonds than international bonds