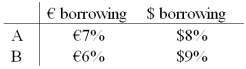

A is a U.S.-based MNC with AAA credit; B is an Italian firm with AAA credit.Firm A wants to borrow €1,000,000 for one year and B wants to borrow $2,000,000 for one year.The spot exchange rate is $2.00 = €1.00,a swap bank makes the following quotes for 1-year swaps and AAA-rated firms against USD LIBOR:  The firm's external borrowing opportunities are:

The firm's external borrowing opportunities are:

Definitions:

Text Message

A short electronic message sent over a cellular network from one cell phone to another.

Positive Correlation

A relationship between two variables where both variables move in the same direction, meaning as one variable increases, the other variable also increases.

Gym

A facility equipped with specialized machines, weights, and areas for physical exercise and training.

Incidence Of Fleas

The occurrence rate or frequency at which fleas infest a population of animals or environment.

Q2: Shareholders of U.S.bidders (acquiring firms in M&A)experience

Q19: Such products as mineral ore and cement

Q41: Proceeding the Asian crisis,<br>A)domestic price bubbles in

Q76: An Edge Act bank is typically located

Q82: The secondary equity markets of the world

Q84: The models that the credit rating firms

Q87: A common set of factors that affect

Q88: Unlike a bond issue,in which the entire

Q96: LIBOR<br>A)is a market rate, analogous to the

Q99: The current exchange rate is £1.00 =