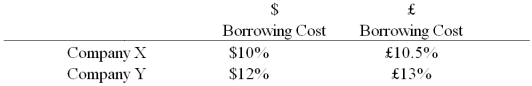

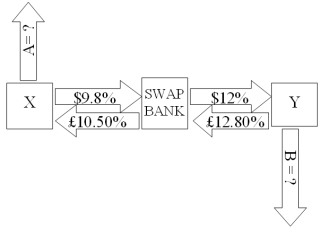

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow £5,000,000 fixed for 5 years.The exchange rate is $2 = £1 and is not expected to change over the next 5 years.Their external borrowing opportunities are:  A swap bank proposes the following interest-only swap: Company X will pay the swap bank annual payments on $10,000,000 at an interest rate of $9.80%; in exchange the swap bank will pay to company X interest payments on £5,000,000 at a fixed rate of 10.5%.Y will pay the swap bank interest payments on £5,000,000 at a fixed rate of 12.80% and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of 12%.

A swap bank proposes the following interest-only swap: Company X will pay the swap bank annual payments on $10,000,000 at an interest rate of $9.80%; in exchange the swap bank will pay to company X interest payments on £5,000,000 at a fixed rate of 10.5%.Y will pay the swap bank interest payments on £5,000,000 at a fixed rate of 12.80% and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of 12%.  If company X takes on the swap,what external actions should they engage in?

If company X takes on the swap,what external actions should they engage in?

Definitions:

Communards

Participants in the Paris Commune, a radical socialist and revolutionary government that briefly ruled Paris in 1871.

Lower-Middle Class

A social class positioned below the upper-middle class, typically comprised of semi-professionals, skilled craftsmen, and lower-level management.

Red Shirts

Volunteers who followed the Italian patriot and general Giuseppe Garibaldi during his campaigns for the unification of Italy in the 19th century.

Giuseppe Garibaldi

An Italian general, patriot, and nationalist who played a key role in the unification of Italy, known for his leadership in the campaign and battles that consolidated different states of the Italian Peninsula into a single nation.

Q2: When using the current/noncurrent method,current assets are

Q7: Which of the following is a translation

Q9: Floating for floating currency swaps<br>A)the reference rates

Q14: The LIBOR rate for euro<br>A)is EURIBOR.<br>B)is a

Q50: The spot exchange rate is ¥125 =

Q64: Consider a fixed for fixed currency swap.The

Q64: Examples of transfer risk include<br>A)the unexpected imposition

Q66: Considering the fact that many barriers to

Q88: "Call market" and "crowd trading" take place

Q90: To avoid buying a stock at a