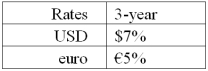

Suppose that you are a swap bank and you notice that interest rates on coupon bonds are as shown.Develop the 3-year bid price of a euro swap quoted against flat USD LIBOR.The current spot exchange rate is $1.50 per €1.00.The size of the swap is €40 million versus $60 million.  In other words,what will you be willing to pay in euro against receiving USD LIBOR?

In other words,what will you be willing to pay in euro against receiving USD LIBOR?

Definitions:

Non-Strategic Investments

Investments made without a long-term plan or alignment with the core goals of an investor or organization.

Short Or Long-Term

A classification that distinguishes between assets, liabilities, or goals based on the duration, typically under or over one year, respectively.

Equity Securities

Financial instruments that signify an ownership position in a publicly-traded corporation, such as stocks.

Long-Term Investments

Assets that a company intends to hold for more than one fiscal year, including stocks, bonds, real estate, and other securities.

Q11: Consider a U.S.-based MNC with a wholly-owned

Q15: ADRs<br>A)are American Depository Receipts.<br>B)denominated in U.S.dollars that

Q16: The most widely used futures contract for

Q19: Companies domiciled in countries with weak investor

Q48: MNCs may undertake overseas investment projects in

Q72: Solve for the weighted average cost of

Q80: Hedge fund advisors typically receive a "2-plus-twenty"

Q83: The link between the home currency value

Q88: Exposure to currency risk can be measured

Q95: On the NYSE,limit order prices receive preference