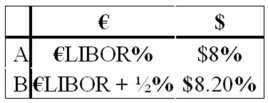

Come up with a swap (principal + interest)for two parties A and B who have the following borrowing opportunities.  The current exchange rate is $1.60 = €1.00.Company "A" wishes to borrow $1,000,000 for 5 years and "B" wants to borrow €625,000 for 5 years.You are a swap dealer.Quote A and B a swap that makes money for all parties and eliminates exchange rate risk for both A and B.Firms A and B are more concerned with what currency that they borrow in than whether the debt is fixed or floating.

The current exchange rate is $1.60 = €1.00.Company "A" wishes to borrow $1,000,000 for 5 years and "B" wants to borrow €625,000 for 5 years.You are a swap dealer.Quote A and B a swap that makes money for all parties and eliminates exchange rate risk for both A and B.Firms A and B are more concerned with what currency that they borrow in than whether the debt is fixed or floating.

Definitions:

Classifications

Systems of categorizing or organizing items into groups based on shared characteristics or criteria.

Exudative Skin Condition

A dermatological condition characterized by the oozing of fluid or pus from the skin, often due to inflammation or infection.

Herpes Simplex Virus

A common viral infection that causes sores typically around the mouth (HSV-1) or genital area (HSV-2).

Painful Blisters

A condition characterized by small, often uncomfortable fluid-filled sacs on the skin.

Q2: Compute the debt-to-equity ratio for a firm

Q12: Using your results to the last question,use

Q17: A specialist on the NYSE<br>A)is obliged to

Q28: A "primary" stock market is<br>A)a big internationally-important

Q52: Stock in Daimler AG,the famous German automobile

Q52: Exchange rate fluctuations contribute to the risk

Q57: The formula for beta is:<br>A) <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2453/.jpg"

Q79: Only in the _ did world investors

Q84: A swap bank<br>A)can act as a broker,

Q91: Transfer risk refers to the risk which