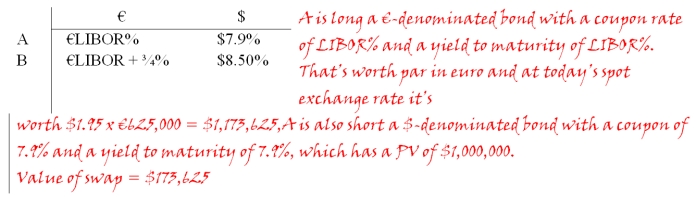

Suppose that the swap that you proposed in question 2 is now 4 years old (i.e.there is exactly one year to go on the swap).If the spot exchange rate prevailing in year 4 is $1.8778 = €1 and the 1-year forward exchange rate prevailing in year 4 is $1.95 = €1,what is the value of the swap to the party paying dollars? If the swap were initiated today the correct rates would be as shown:  Consider the situation of firm A and firm B.The current exchange rate is $1.50/€.Firm A is a U.S.MNC and wants to borrow €40 million for 2 years.Firm B is a French MNC and wants to borrow $60 million for 2 years.Their borrowing opportunities are as shown; both firms have AAA credit ratings.

Consider the situation of firm A and firm B.The current exchange rate is $1.50/€.Firm A is a U.S.MNC and wants to borrow €40 million for 2 years.Firm B is a French MNC and wants to borrow $60 million for 2 years.Their borrowing opportunities are as shown; both firms have AAA credit ratings.

Definitions:

Depressant

A substance that reduces arousal or stimulation in various parts of the brain, often used to treat anxiety or insomnia.

Barbiturates

A class of drugs that are used as sedatives and hypnotics, and also for the treatment of epilepsy and insomnia, but have a high potential for abuse and addiction.

Mescaline

A psychedelic compound derived from the peyote cactus, known for its hallucinogenic effects, used both in traditional spiritual ceremonies and recreationally.

Consciousness

A state of awareness of oneself and the environment.

Q3: A major that can be eliminated through

Q11: You are a bank and your customer

Q24: A 2-year,4 percent euro denominated bond sells

Q40: The sale of new common stock by

Q45: Which of the following are true statements?<br>A)Since

Q60: A market-value index<br>A)is calculated such that the

Q75: Find the debt-to-value ratio for a firm

Q84: Prior to Honda's decision to build a

Q85: Eurobonds are usually<br>A)bearer bonds.<br>B)registered bonds.<br>C)bulldog bonds.<br>D)foreign currency

Q91: Transfer risk refers to the risk which