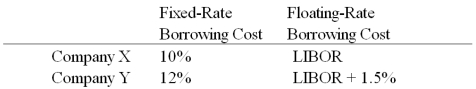

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years.Their external borrowing opportunities are shown below:  A swap bank proposes the following interest only swap: Y will pay the swap bank annual payments on $10,000,000 with a fixed rate of 9.90%.In exchange the swap bank will pay to company Y interest payments on $10,000,000 at LIBOR - 0.15%; What is the value of this swap to company Y?

A swap bank proposes the following interest only swap: Y will pay the swap bank annual payments on $10,000,000 with a fixed rate of 9.90%.In exchange the swap bank will pay to company Y interest payments on $10,000,000 at LIBOR - 0.15%; What is the value of this swap to company Y?

Definitions:

Market Analysis

An evaluation to understand the dynamics of a specific market, including size, trends, and competition.

Red Herring Prospectus

A preliminary document shared by a company with potential investors before an initial public offering (IPO), which details the company's operations and financials but does not include the price or size of the offering.

Executive Summary

A brief section at the beginning of a document, summarizing the most important points for quick review.

Forecasting External Financing

It involves predicting the amount of external funding a company will need to support its anticipated growth and operational needs.

Q7: Fill out the following figure with the

Q7: As of today,the spot exchange rate is

Q8: Suppose that the firm's cost of capital

Q20: Why can blocked funds can be detrimental

Q24: For a recent month,the following payments matrix

Q32: With regard to clearing procedures for bond

Q50: A bank bought a "three against six"

Q63: A classic example for trade barrier-motivated FDI

Q64: Hedge fund advisors typically receive a management

Q85: Eurobonds are usually<br>A)bearer bonds.<br>B)registered bonds.<br>C)bulldog bonds.<br>D)foreign currency