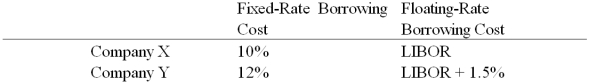

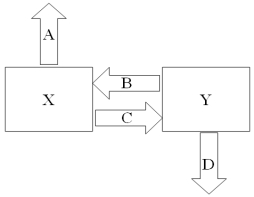

Company X wants to borrow $10,000,000 floating for 5 years.Company Y wants to borrow $10,000,000 fixed for 5 years.Their external borrowing opportunities are:  Design a mutually beneficial interest only swap for X and Y with a notational principal of $10 million by having appropriate values for A = Company X's external borrowing rate

Design a mutually beneficial interest only swap for X and Y with a notational principal of $10 million by having appropriate values for A = Company X's external borrowing rate

B = Company Y's payment to X (rate)

C = Company X's payment to Y (rate)

D = Company Y's external borrowing rate

Definitions:

General Library

A public or private space offering access to a wide variety of books and informational resources for reading, study, and research.

Private Organizations

Entities that are owned and operated by individuals or corporations rather than by the government, focusing on profit or nonprofit goals.

Material Types

Varieties of substances or resources used in the production of goods or in the execution of projects and tasks.

Specialized Search Engine

A search engine designed to focus on a specific segment of online content, providing targeted and relevant results for users interested in that particular area.

Q23: The generally accepted method for consolidating the

Q27: Under which method does the gain or

Q28: When the choice of financing a foreign

Q38: Perhaps the most important decisions that confront

Q50: Explain how this opportunity affects which swap

Q53: In any given year,rightly 80 percent of

Q66: Calculate the euro-based return an Italian investor

Q79: The underwriting syndicate of a bond offering

Q89: Correspondent bank relationships can be beneficial<br>A)because a

Q95: Some countries allow interaffiliate transactions to be