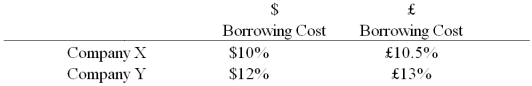

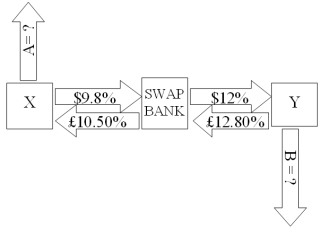

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow £5,000,000 fixed for 5 years.The exchange rate is $2 = £1 and is not expected to change over the next 5 years.Their external borrowing opportunities are:  A swap bank proposes the following interest-only swap: Company X will pay the swap bank annual payments on $10,000,000 at an interest rate of $9.80%; in exchange the swap bank will pay to company X interest payments on £5,000,000 at a fixed rate of 10.5%.Y will pay the swap bank interest payments on £5,000,000 at a fixed rate of 12.80% and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of 12%.

A swap bank proposes the following interest-only swap: Company X will pay the swap bank annual payments on $10,000,000 at an interest rate of $9.80%; in exchange the swap bank will pay to company X interest payments on £5,000,000 at a fixed rate of 10.5%.Y will pay the swap bank interest payments on £5,000,000 at a fixed rate of 12.80% and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of 12%.  If company X takes on the swap,what external actions should they engage in?

If company X takes on the swap,what external actions should they engage in?

Definitions:

Unlimited Liability

A legal structure in which owners are personally and fully responsible for all debts and liabilities incurred by the business.

Personal Assets

Assets owned by an individual as opposed to those owned by businesses or governments, including tangible and intangible items.

Original Capital Investment

The initial sum of money used to start a business or investment, often used for assets, inventory, and other startup costs.

Net Income

The total profit or loss of a company after all revenues and expenses have been accounted for, often referred to as the bottom line.

Q1: Company X wants to borrow $10,000,000 floating

Q4: "Yankee" bonds are<br>A)dollar-denominated foreign bonds originally sold

Q10: Recent studies show that when investors control

Q21: Studies examining the influence of industrial structure

Q25: Using your results to the last question,make

Q41: Company X wants to borrow $10,000,000 floating

Q45: A bank may establish a multinational operation

Q81: FDI vertical integration is backward<br>A)when FDI involves

Q91: A five-year,4 percent Euroyen bond sells at

Q93: With regard to a swap bank acting