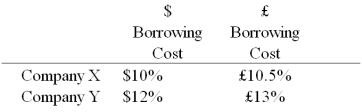

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow £5,000,000 fixed for 5 years.The exchange rate is $2 = £1 and is not expected to change over the next 5 years.Their external borrowing opportunities are:  A swap bank wants to design a profitable interest-only fixed-for-fixed currency swap.In order for X and Y to be interested,they can face no exchange rate risk

A swap bank wants to design a profitable interest-only fixed-for-fixed currency swap.In order for X and Y to be interested,they can face no exchange rate risk  What must the values of A and B in the graph shown above be in order for the swap to be of interest to firms X and Y?

What must the values of A and B in the graph shown above be in order for the swap to be of interest to firms X and Y?

Definitions:

Q2: Find the NPV in euro for the

Q6: Find the ex post IRR in euro

Q21: Studies examining the influence of industrial structure

Q28: Company X wants to borrow $10,000,000 floating

Q51: The variance of the exchange rate is:<br>A)0.0200<br>B)0.101875<br>C)0.002<br>D)none

Q66: Calculate the euro-based return an Italian investor

Q66: Adler and Simon (1986)examined the exposure of

Q74: In implementing FASB 52,<br>A)the functional currency of

Q76: Suppose your firm needs to raise €100,000,000

Q92: Bema Gold is an exploration and production