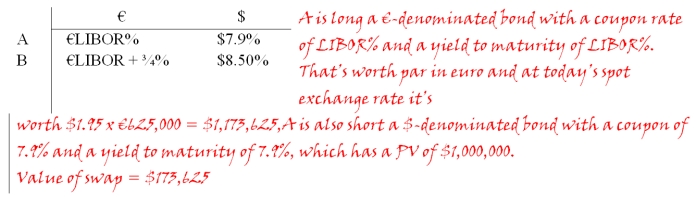

Suppose that the swap that you proposed in question 2 is now 4 years old (i.e.there is exactly one year to go on the swap).If the spot exchange rate prevailing in year 4 is $1.8778 = €1 and the 1-year forward exchange rate prevailing in year 4 is $1.95 = €1,what is the value of the swap to the party paying dollars? If the swap were initiated today the correct rates would be as shown:  Consider the situation of firm A and firm B.The current exchange rate is $1.50/€.Firm A is a U.S.MNC and wants to borrow €40 million for 2 years.Firm B is a French MNC and wants to borrow $60 million for 2 years.Their borrowing opportunities are as shown; both firms have AAA credit ratings.

Consider the situation of firm A and firm B.The current exchange rate is $1.50/€.Firm A is a U.S.MNC and wants to borrow €40 million for 2 years.Firm B is a French MNC and wants to borrow $60 million for 2 years.Their borrowing opportunities are as shown; both firms have AAA credit ratings.

Definitions:

Inflexible

characterizes an unwillingness or inability to change or adapt to new circumstances, ideas, or information.

Stereotyping

The act of assigning a set of characteristics to people based on their membership in a particular group, often oversimplifying and having negative connotations.

Perceptual Distortion

The misinterpretation or misperception of a real external stimulus, often influenced by an individual's mental state or preconceptions.

Halo Effects

A cognitive bias where the perception of one positive trait leads to the assumption of other positive traits in an individual or thing.

Q14: The underlying philosophy of the monetary/nonmonetary method

Q17: A "foreign bond" issue is<br>A)one denominated in

Q25: Investment in foreign equity markets<br>A)is no longer

Q37: Currency risk<br>A)is the same as currency exposure.<br>B)represents

Q38: Under the monetary/nonmonetary method,revenue and expense items

Q61: A "registered bond" is one that<br>A)shows the

Q69: In the notation of the book,K

Q71: The required return on equity for a

Q77: Find the break-even price (in dollars)and break-even

Q93: What is the euro-denominated IRR of this