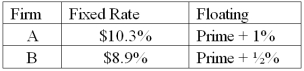

Consider the borrowing rates for Parties A and B.A wants to finance a $100,000,000 project at a FIXED rate.B wants to finance a $100,000,000 project at a FLOATING rate.Both firms want the same maturity,in 5 years.  Construct a mutually beneficial INTEREST ONLY swap that makes money for A,B,and the swap bank IN EQUAL MEASURE.

Construct a mutually beneficial INTEREST ONLY swap that makes money for A,B,and the swap bank IN EQUAL MEASURE.

Definitions:

Uterine Cancer

A type of cancer that occurs in the uterus, the organ in a woman's pelvis where a baby develops during pregnancy, involving abnormal growth of cells that have the ability to invade or spread to other parts of the body.

Femur

The thigh bone, which is the longest and strongest bone in the human body, extending from the hip to the knee.

Epidural Anaesthetic

A type of anesthesia that is injected into the space around the spinal nerves in the lower back, causing loss of sensation in the lower body, commonly used during childbirth and certain surgeries.

Reversal Agent

A drug used to negate the effects of another drug, often used in cases of overdose or poisoning.

Q1: The Asian crisis<br>A)followed a period of economic

Q4: Companies domiciled in countries with weak investor

Q6: Consider a U.S.MNC with operations in Great

Q11: Systematic risk<br>A)is also known as non-diversifiable risk.<br>B)is

Q29: Straight fixed-rate bond issues have<br>A)a designated maturity

Q34: Unlike day orders,a good-til-cancelled (GTC)order is an

Q55: A "global bond" issue<br>A)is a very large

Q64: When the Mexican peso collapsed in 1994,declining

Q90: Consider a U.S.-based MNC with a wholly-owned

Q98: Find the dollar cash flows to compute