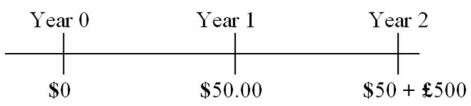

Find the value today of a 2-year dual currency bond with annual coupons (paid in U.S.dollars at a 5 percent coupon rate) that pays £500 per $1,000 par value at maturity.The cash flows of the bond are:

The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; expected inflation over the next three years is $ = 2% in the U.S.and £ = 3% in the U.K.

Definitions:

Common-sized Financial Statements

Financial statements that present all line items as a percentage of a common base figure, facilitating comparison across periods or companies.

Comparative Statements

Financial statements that present data for more than one accounting period side by side to facilitate analysis and identify trends.

Price-level Accounting

An accounting method that adjusts financial statements to reflect changes in the purchasing power of money due to inflation or deflation.

Working Capital

The difference between a company's current assets and current liabilities, indicating the short-term liquidity of the company.

Q7: Find the value of a one-year call

Q21: Underwriters for a domestic bond issue will

Q32: In the London market,Rolls-Royce stock closed at

Q35: Correspondent bank services include<br>A)prepaid postage and packing

Q41: The sensitivity of the firm's consolidated financial

Q51: More than fifty percent of FDI in

Q61: Find the hedge ratio for a call

Q66: Suppose the futures price is below the

Q74: Emerald Energy is an oil exploration and

Q93: Proportionately more domestic bonds than international bonds