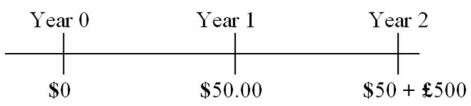

Find the value today of a 2-year dual currency bond with annual coupons (paid in U.S.dollars at a 5 percent coupon rate) that pays £500 per $1,000 par value at maturity.The cash flows of the bond are:

The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; expected inflation over the next three years is $ = 2% in the U.S.and £ = 3% in the U.K.

Definitions:

Intelligence System

A computer-based system that collects, analyzes, and presents information to aid in decision-making and strategic planning.

Online Recruiting

The process of using the Internet to actively seek out and recruit talented candidates for an organization's open positions.

Web-based HR

Refers to the use of online platforms and tools for managing human resources processes and activities, offering accessibility and efficiency improvements.

Replacement Planning

A component of succession planning focusing on identifying immediate backup candidates for key positions to ensure minimal disruption in case of sudden vacancies.

Q3: Private placement bond issues<br>A)do not have to

Q6: Consider the balance sheets of Bank A

Q7: In a push to serve the North

Q12: Regarding the mechanics of international portfolio diversification,which

Q16: Country risk<br>A)is a broader measure of risk

Q29: With regard to estimates of "world beta"

Q54: With regard to the financial structure of

Q71: A is a U.S.-based MNC with AAA

Q89: Find the present value of a 3-year

Q97: In evaluating political risk,experts focus their attention