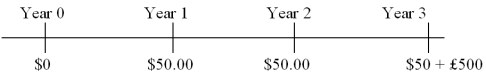

Find the value of a three-year dual currency bond with annual coupons (paid in U.S.dollars at a 5 percent coupon rate) that pays £500 per $1,000 par value at maturity.The cash flows of the bond are:

The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; expected inflation over the next three years is $ = 2% in the U.S.and £ = 3% in the U.K.

Definitions:

Dividends Per Share

The amount of dividends that are paid out per share of a company's stock.

Contributed Shares

Shares issued to investors or others as part of the equity financing of a company, represents part of the capital contributed by the shareholders.

Authorized Shares

The maximum number of shares that a corporation is legally permitted to issue, as specified in its articles of incorporation.

Q17: Your firm is a Swiss importer of

Q24: Which of the following are principles of

Q28: A disproportionate share of Eurobonds have high

Q40: Exchange rate risk of a foreign currency

Q47: One explanation for foreign equity ownership restrictions<br>A)is

Q53: The third most important host country for

Q54: Your firm has just issued five-year floating-rate

Q66: Adler and Simon (1986)examined the exposure of

Q81: A U.S.-based multinational bank<br>A)would not have to

Q101: You entered in to a 3*6 forward