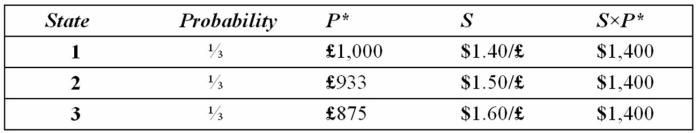

Suppose a U.S.firm has an asset in Britain whose local currency price is random.For simplicity,suppose there are only three states of the world and each state is equally likely to occur.The future local currency price of this British asset (P*) as well as the future exchange rate (S) will be determined,depending on the realized state of the world.  Which of the following statements is most correct?

Which of the following statements is most correct?

Definitions:

Static Budget

A budget based on a fixed set of assumptions and not adjusted for actual activity levels.

Guest-Days

A measure used in the hospitality industry to quantify the total number of days guest have stayed.

Total Fixed Cost

It encompasses all the expenses that do not change regardless of the business activity volume, such as rent and salaries.

Servicing Materials

Supplies or materials used in the maintenance and repair of products or equipment.

Q6: The first ADRs began trading _ as

Q8: If you borrowed €1,000,000 for one year,how

Q11: If you borrowed €1,000,000 for one year,how

Q57: Global bond issues<br>A)can save U.S.issuers 20 basis

Q61: A market order<br>A)is an instruction from a

Q77: The coupon interest on Eurobonds<br>A)is paid annually.<br>B)is

Q79: Under which accounting method are most income

Q84: A Japanese EXPORTER has a €1,000,000 receivable

Q88: There is (at least)one profitable arbitrage at

Q97: The variance of the exchange rate is:<br>A)0.001968<br>B)0.002969<br>C)0.003968<br>D)0.004968