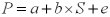

From the perspective of the U.S.firm that owns an asset in Britain,the exposure that can be measured by the coefficient b in regressing the dollar value P of the British asset on the dollar/pound exchange rate S using the regression equation  is

is

Definitions:

John Jacob Astor

A German-American businessman, merchant, real estate mogul, and investor known for being one of the wealthiest people in America in the early 19th century, notably in the fur trade and for purchasing vast amounts of land in New York City.

Self-Made Man

A person who has achieved success or wealth through their own efforts, particularly from a starting point of low status or disadvantage.

American Birthrate

The statistical measure that denotes the number of live births per thousand people in the United States within a given time period.

Nineteenth Century

The period from 1801 to 1900, marked by significant political, social, and technological changes worldwide.

Q4: Consider a U.S.-based MNC with manufacturing activities

Q25: The key weakness of the public corporation

Q37: The SF/$ spot exchange rate is SF1.25/$

Q42: If you own a foreign currency denominated

Q56: The world's largest foreign exchange trading center

Q65: A CFO should be least worried about<br>A)transaction

Q74: Suppose that the exchange rate is €1.25

Q85: Which equation is used to define the

Q88: "Call market" and "crowd trading" take place

Q96: Consider a bank dealer who faces the