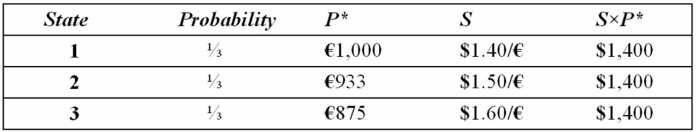

Suppose a U.S.firm has an asset in Italy whose local currency price is random.For simplicity,suppose there are only three states of the world and each state is equally likely to occur.The future local currency price of this asset (P*) as well as the future exchange rate (S) will be determined,depending on the realized state of the world.  Assume that you choose to "hedge" this asset by selling forward the expected value of the euro denominated cash flow at F1($/£) = $1.50/€.Calculate your cash flows in each of the possible states.

Assume that you choose to "hedge" this asset by selling forward the expected value of the euro denominated cash flow at F1($/£) = $1.50/€.Calculate your cash flows in each of the possible states.

Definitions:

Blood Specimen

A sample of blood taken for testing, analysis, or use in medical diagnosis.

Tourniquet

A device used to apply pressure to a limb or extremity in order to limit but not stop the flow of blood, commonly used in medical emergencies or surgeries.

Hematology

The branch of medicine involved with the study and treatment of blood diseases and the organs involved in forming blood.

Enzyme-Linked Immunosorbent Assay

A laboratory technique used for detecting and quantifying substances such as peptides, proteins, antibodies, and hormones.

Q1: Your firm has a British customer that

Q35: The International Fisher Effect suggests that<br>A)any forward

Q48: Which of the following options strategies are

Q56: When the bond sells at par,the implicit

Q57: The firm may not be subject to

Q65: In reference to capital requirements,value-at-risk analysis<br>A)refers to

Q68: Bonds with equity warrants<br>A)are really the same

Q88: "Call market" and "crowd trading" take place

Q97: When a currency trades at a premium

Q98: In 2002,24 stock markets had concentration ratios