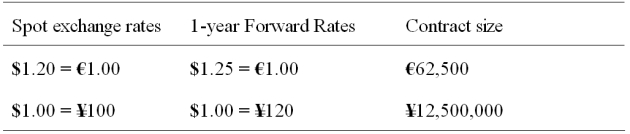

A Japanese IMPORTER has a €1,000,000 PAYABLE due in one year.  The one-year risk free rates are i$ = 4.03%; i€ = 6.05%; and i¥ = 1%.Detail a strategy using forward contracts that will hedge his exchange rate risk.Have an estimate of how many contracts of what type.

The one-year risk free rates are i$ = 4.03%; i€ = 6.05%; and i¥ = 1%.Detail a strategy using forward contracts that will hedge his exchange rate risk.Have an estimate of how many contracts of what type.

Definitions:

Q4: Companies domiciled in countries with weak investor

Q20: Capital account includes<br>A)(i), (ii), and (iii)<br>B)(ii), (iii),

Q30: In comparison to the current/noncurrent method,the monetary/nonmonetary

Q34: Find the price of a 30-year zero

Q46: What is the correct label for the

Q60: The floor value of a convertible bond<br>A)is

Q70: Good,inexpensive,and fairly reliable predictors of future exchange

Q73: The vast majority of new international bond

Q85: Your firm is a U.K.-based importer of

Q99: A currency depreciation will begin to improve