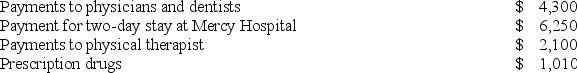

Dotty,age 45,incurred the following medical expenses this year.

Dotty's insurance company reimbursed her for $8,800 of these expenses.If Dotty's AGI is $35,400,compute her medical expense deduction.

Dotty's insurance company reimbursed her for $8,800 of these expenses.If Dotty's AGI is $35,400,compute her medical expense deduction.

Definitions:

Morality

Principles concerning the distinction between right and wrong or good and bad behavior.

Personality

The unique combination of psychological traits that influence how an individual interacts with their environment.

Indiscriminately

Done without careful judgment or selective consideration, affecting or applying to many without distinction.

Continuing Desire

An ongoing longing or wish for someone or something, potentially driving motivation and actions.

Q5: Which of the following statements regarding the

Q22: Ms.Watts owns stock in two S corporations,MKP

Q26: Which of the following benefits does not

Q36: Given the possible outcomes to a lottery

Q39: *In Game 4 above,<br>A) There is one

Q43: Mrs.Hepp completed her 2016 Form 1040 on

Q50: Mr.Bentley exchanged investment land subject to a

Q59: A family partnership can be used to

Q62: Glover,Inc.had $350,000 of taxable income,all of which

Q96: When a corporation is thinly capitalized,the IRS