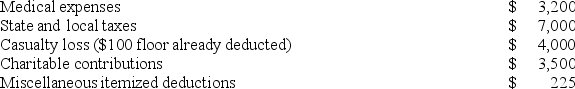

Mr.and Mrs.Hunt,ages 38 and 33,have the following allowable itemized deductions this year.  Determine the effect on the amount of each deduction if the Hunts engage in a transaction generating $10,000 additional AGI this year.

Determine the effect on the amount of each deduction if the Hunts engage in a transaction generating $10,000 additional AGI this year.

Definitions:

BoardSource

An organization that specializes in providing support, resources, and training for nonprofit board officers and directors.

Finance Committee

A subgroup within an organization, typically composed of members of its governing body, responsible for overseeing financial policies, strategies, and health.

Financial Expert

A professional with extensive knowledge and skills in financial markets, investment strategies, and financial planning.

Organization's Investments

Relates to the allocation of resources by an organization into projects, assets, or initiatives with the expectation of achieving future benefits or returns.

Q1: For federal income tax purposes,a taxpayer may

Q12: Mrs.Raines died on June 2,2016.Mr.Raines has not

Q16: All of the following statements are true

Q22: Mr.and Mrs.Dint filed their 2016 Form 1040

Q25: Contributions to an employer-sponsored qualified retirement plan

Q47: Which of the following deductions is disallowed

Q70: A flood destroyed a business asset owned

Q76: Any gain recognized on the sale of

Q91: Harry and Sally were married on December

Q104: Six years ago,Linus Corporation granted Pauline a