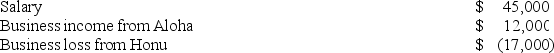

Ms.Mollani owns stock in two S corporations,Aloha and Honu.This year,she had the following income and loss items:

Compute Ms.Mollani's AGI under each of the following assumptions.

Compute Ms.Mollani's AGI under each of the following assumptions.

a.She materially participates in Aloha's business but not in Honu's business.

b.She materially participates in Honu's business but not in Aloha's business.

c.She materially participates in both corporate businesses.

d.She does not materially participate in either business.

Definitions:

Forelimbs Absence

A condition or evolutionary adaptation where an organism lacks front limbs, which may be a result of adaptation to its environment or evolutionary history.

Genetically Engineer

The process of deliberately modifying the genetic structure of an organism to introduce new traits or capabilities.

Cervical Vertebrae

The vertebrae of the neck, which form the upper part of the vertebral column and support the skull while allowing for a range of head movements.

Metabolic Rates

The rate at which the body uses energy to maintain basic life functions, such as breathing, blood circulation, and cell production.

Q2: Three individuals transferred property to newly formed

Q3: Kate recognized a $25,700 net long-term capital

Q12: Bryan Houlberg expects his C corporation to

Q17: Sue,a single taxpayer,purchased a principal residence in

Q18: Mr.and Mrs.Latt use a fiscal year ending

Q26: A congestion toll is<br>A) like an emissions

Q51: The tax basis in property received in

Q63: The net operating losses of a C

Q65: Polly received the following items this year.

Q76: Investment expenses are a miscellaneous itemized deduction