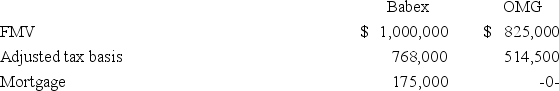

Babex Inc.and OMG Company entered into an exchange of real property.Here is the information for the properties to be exchanged.

Pursuant to the exchange,OMG assumed the mortgage on the Babex property.Compute OMG's gain recognized on the exchange and its tax basis in the property received from Babex.

Pursuant to the exchange,OMG assumed the mortgage on the Babex property.Compute OMG's gain recognized on the exchange and its tax basis in the property received from Babex.

Definitions:

Income Statement

A financial document that reports a company's financial performance over a specific period, including revenue, expenses, and net income.

Income Tax Expense

The total amount of income tax that a company is obliged to pay to tax authorities, based on its earnings.

Taxes Payable

The amount of tax liability a company or individual owes to a tax authority but has not yet paid.

Preferred Dividends

Preferred dividends are fixed dividend payments issued to preferred shareholders, prioritized over common stock dividends.

Q24: Which of the following statements regarding the

Q25: Which of the following statements about the

Q31: A partner in a limited liability partnership

Q36: A cafeteria plan allows employees to select

Q39: The highest individual marginal rate for regular

Q47: A book/tax difference resulting from application of

Q52: Which of the following is not a

Q63: Five years ago,Q&J Inc.transferred land with a

Q78: For tax purposes,the cost basis of an

Q80: A taxpayer who loses a case in