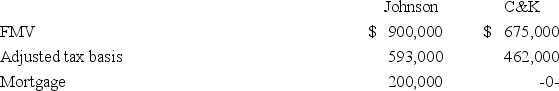

Johnson Inc.and C&K Company entered into an exchange of real property.Here is the information for the properties to be exchanged.

Pursuant to the exchange,C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property.Compute Johnson's gain recognized on the exchange and its tax basis in the property received from C&K.

Pursuant to the exchange,C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property.Compute Johnson's gain recognized on the exchange and its tax basis in the property received from C&K.

Definitions:

Hypothalamus

A region of the brain responsible for hormone production and regulation of vital bodily functions, including temperature, hunger, and thirst.

Oxytocin

A hormone released by the pituitary gland that causes increased contraction of the uterus during labor and stimulates the ejection of milk into the ducts of the breasts.

Calcitonin

A hormone produced by the thyroid gland that helps regulate blood calcium levels by lowering them when they are high.

Calcium Ion Concentration

The level of calcium ions (Ca2+) in a particular system, important for various cellular processes including signal transduction and muscle contraction.

Q37: Jackey Company,a calendar year,accrual basis taxpayer,did not

Q44: Which of the following statements about the

Q55: Creighton,a calendar year corporation,reported $5,571,000 net income

Q64: Hank exchanged an old asset with a

Q79: McOwen Inc.reported $6,029,400 net income before tax

Q80: An unfavorable temporary book/tax difference generates a

Q104: Noble Inc.paid $310,000 for equipment three years

Q104: Which of the following are included in

Q107: Tauber Inc.and J&I Company exchanged like-kind production

Q109: Which of the following situations result in