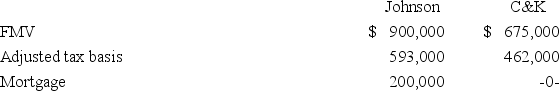

Johnson Inc.and C&K Company entered into an exchange of real property.Here is the information for the properties to be exchanged.

Pursuant to the exchange,C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property.Compute C&K's gain recognized on the exchange and its tax basis in the property received from Johnson.

Pursuant to the exchange,C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property.Compute C&K's gain recognized on the exchange and its tax basis in the property received from Johnson.

Definitions:

Sustainability

The practice of conducting activities in a way that ensures long-term preservation of natural and societal resources, often emphasizing environmental protection, social equity, and economic viability.

Green Business Practices

Sustainable and environmentally friendly methods employed by companies to minimize their ecological footprint.

Energy Use

The amount of energy consumed in a process or by an organization, household, or device, often with a focus on reducing negative environmental impact.

Capacity

The maximum amount that something can contain or produce.

Q12: Molton Inc.made a $60,000 cash expenditure this

Q24: Which of the following statements regarding the

Q29: Tregor Inc.,which manufactures plastic components,rents equipment on

Q35: Based on the citation Rev.Rul.89-157,1989-1 C.B.221:<br>A)This revenue

Q38: Which of the following entities does not

Q42: When unrelated parties agree to an exchange

Q55: A planning strategy that defers a tax

Q59: Tax expense per books is based on:<br>A)Before-tax

Q98: Which of the following statements concerning the

Q98: Self-employed individuals are allowed to deduct the