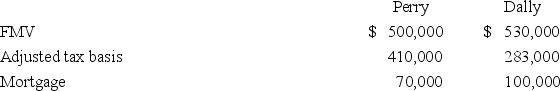

Perry Inc.and Dally Company entered into an exchange of real property.Here is the information for the properties to be exchanged.

Pursuant to the exchange,Perry assumed the mortgage on the Dally property,and Dally assumed the mortgage on the Perry property.Compute Perry's gain recognized on the exchange and its tax basis in the property received from Dally.

Pursuant to the exchange,Perry assumed the mortgage on the Dally property,and Dally assumed the mortgage on the Perry property.Compute Perry's gain recognized on the exchange and its tax basis in the property received from Dally.

Definitions:

Affirming the Consequent

A logical fallacy in which a conclusion is incorrectly derived from a conditional statement (if A, then B; B, therefore A).

Straw Man Fallacy

A logical fallacy that involves misrepresenting an argument to make it easier to attack.

Appeal to Emotion

A logical fallacy where an argument is made by manipulating the emotions of the audience rather than by using valid reasoning.

Circular Reasoning

A logical fallacy in which the conclusion is assumed in one of the premises.

Q10: Ms.Adair,a single individual,has $218,000 AGI,which includes $43,000

Q19: Delour Inc.was incorporated in 2011 and adopted

Q37: Oslego Company,a calendar year taxpayer,sold land with

Q44: The same asset may be an ordinary

Q58: Why does the federal tax law disallow

Q61: For tax purposes,every asset is a capital

Q78: This year,Adula Company sold equipment purchased in

Q86: Laine Services,a calendar year taxpayer,billed a client

Q94: Stanley Inc.,a calendar year taxpayer,purchased a building

Q105: Six years ago,HOPCO granted Ms.Cardena a nonqualified