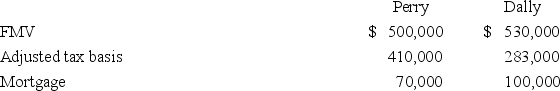

Perry Inc.and Dally Company entered into an exchange of real property.Here is the information for the properties to be exchanged.

Pursuant to the exchange,Perry assumed the mortgage on the Dally property,and Dally assumed the mortgage on the Perry property.Compute Dally's gain recognized on the exchange and its tax basis in the property received from Perry.

Pursuant to the exchange,Perry assumed the mortgage on the Dally property,and Dally assumed the mortgage on the Perry property.Compute Dally's gain recognized on the exchange and its tax basis in the property received from Perry.

Definitions:

Forming Department

A production department specialized in shaping and assembling parts or materials into finished goods.

Customizing Department

A specialized division within a company focused on tailoring products or services to meet specific customer requirements.

Predetermined Overhead Rate

A rate used to allocate manufacturing overhead cost to products or cost objects, calculated before the accounting period based on estimated costs and activity levels.

Milling Department

A section within a factory or manufacturing facility where materials, such as grains or metals, are ground, cut, or shaped using milling machines.

Q2: In 2015,Mrs.Owens paid $50,000 for 3,000 shares

Q11: Ficia Inc.owned investment land subject to a

Q31: A partner in a limited liability partnership

Q61: Which of the following business expenses always

Q65: Conant Company purchased only one item of

Q67: Randall Company uses the calendar year and

Q74: Which of the following is a consequence

Q77: Ms.Cregg has a $43,790 basis in 2,460

Q84: Which of the following statements regarding the

Q106: Zeron Inc.generated $1,349,600 ordinary income from operations