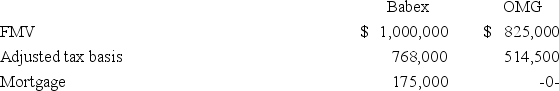

Babex Inc.and OMG Company entered into an exchange of real property.Here is the information for the properties to be exchanged.

Pursuant to the exchange,OMG assumed the mortgage on the Babex property.Compute OMG's gain recognized on the exchange and its tax basis in the property received from Babex.

Pursuant to the exchange,OMG assumed the mortgage on the Babex property.Compute OMG's gain recognized on the exchange and its tax basis in the property received from Babex.

Definitions:

Competitive Market

A market structure characterized by a large number of buyers and sellers, free entry and exit, and a product for which there are many substitutes.

External Benefit

A benefit that people other than the consumer or producer enjoy, resulting from a transaction or activity.

Economic Efficiency

A condition in which all available resources are utilized in the most effective manner to satisfy society's needs and wants, minimizing waste and maximizing value.

Market Price

The current market value at which an asset or service is up for sale or purchase.

Q6: Lars withdrew $20,000 from a retirement account

Q33: Novice tax researchers tend to exam less

Q38: Welch Inc.has used a fiscal ending September

Q58: A taxpayer cannot compute its net Section

Q61: For tax purposes,every asset is a capital

Q67: Which of the following statements about the

Q74: Mr.and Mrs.Gupta want to make cash gifts

Q82: Samantha died on January 18,2017.Her husband Dave

Q102: Mr.Forest,a single taxpayer,recognized a $252,000 loss on

Q113: In 2016,TPC Inc.sold investment land with a