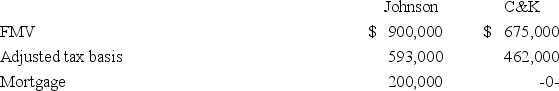

Johnson Inc.and C&K Company entered into an exchange of real property.Here is the information for the properties to be exchanged.

Pursuant to the exchange,C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property.Compute Johnson's gain recognized on the exchange and its tax basis in the property received from C&K.

Pursuant to the exchange,C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property.Compute Johnson's gain recognized on the exchange and its tax basis in the property received from C&K.

Definitions:

Thrill and Adventure Seeking

This refers to the desire or tendency of individuals to engage in activities that are exciting, risky, or adventurous, often for the sensation or experience it provides.

Behavioral Change

A modification in an individual's actions or reactions as a result of experiences, learning, or external influences.

Elation

A state of elevated happiness, joy, or euphoria, often characterized by high energy and enthusiasm.

Detachment

The emotional state in which an individual maintains a boundary from a specific situation or emotional involvement.

Q2: In 2017,Largo Inc.,a calendar year corporation,accrued a

Q9: R&T Inc.made the following sales of capital

Q30: Cobly Company,a calendar year taxpayer,made only one

Q36: A cafeteria plan allows employees to select

Q57: In computing taxable income,an individual is allowed

Q75: Which of the following statements about the

Q75: Zola Inc.paid a $10,000 legal fee to

Q75: Mr.Pearl's total income and self-employment tax on

Q80: Moses Inc.purchased office furniture for $8,200 plus

Q104: Six years ago,Linus Corporation granted Pauline a