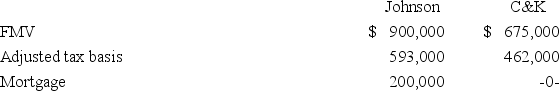

Johnson Inc.and C&K Company entered into an exchange of real property.Here is the information for the properties to be exchanged.

Pursuant to the exchange,C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property.Compute C&K's gain recognized on the exchange and its tax basis in the property received from Johnson.

Pursuant to the exchange,C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property.Compute C&K's gain recognized on the exchange and its tax basis in the property received from Johnson.

Definitions:

Introverted

A personality trait characterized by a focus on internal feelings rather than external sources of stimulation.

Research

Research is the systematic investigation into and study of materials and sources in order to establish facts and reach new conclusions.

Personality Theory

A system of concepts and assumptions that explain the divergence of individuals' psychological traits, patterns of thought, and behaviors.

White Men

Refers specifically to adult male individuals of European descent, often discussed in sociological or demographic contexts.

Q3: Kate recognized a $25,700 net long-term capital

Q29: Denali,Inc.exchanged equipment with a $230,000 adjusted basis

Q35: Julie,an unmarried individual,lives in a home with

Q36: Vincent Company transferred business realty (FMV $2.3

Q44: Sandy,Sue,and Shane plan to open Friends,an upscale

Q56: The tax character of an item of

Q67: Which of the following is not primary

Q106: Goff Inc.'s taxable income is computed as

Q110: Which of the following statements about an

Q112: Mr.Beck sold real property with a $140,000